By CPA James Fredrick Ochieng

Should The Draft Tax Policy See The Light Of Day?

Absence of an Official Tax Policy Complicates Matters

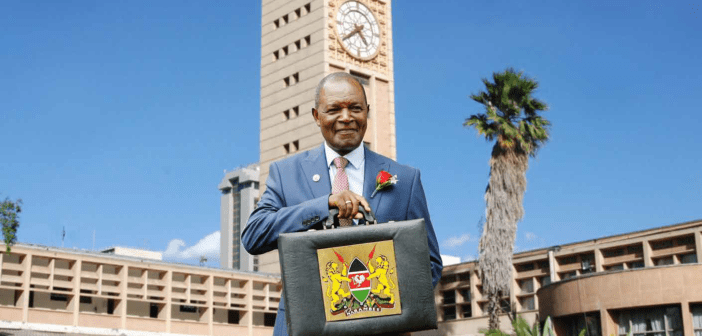

Even as the debate on the finance bill 2023 raged ahead of the 2023/2024 budget reading, one sore thumb for anyone interested in the Kenyan Taxation regime remains the absence of an official tax policy for the Republic of Kenya. This is a reference document that is supposed to guide tax discourse and

tax administration. Some of the new taxes or amendments therein caught many by surprise, anger or despair. It becomes a challenge predicting which cards the treasury mandarins are likely to unleash

from under the table next in an effort to keep the country fiscally afloat

Taxation in itself is not a bad thing. What can be frustrating is lack of consistency and predictability in application of taxation policies. This has always been the gap in the country’s fiscal regime

leading to confusion and frustration, tax cheating, threat of job losses and never ending litigation which by themselves negatively impact on the economy due to the same element of uncertainty. Capital

hates speculation. It will fly to the next destination where it doesn’t feel it is taken for granted.

Several scribes, scholars, tax experts and the wider business community have trumpeted the need for a national tax policy to enhance predictability and certainty of taxation. Various articles have been published on the merits of a guiding handbook on tax administration. The resultant effect is that this will help businesses plan long-term, assist tax experts in predictably advising their clients on tax planning and generally provide economic stability.

The National Treasury responded to the demand for a National Tax Policy sometime in the year 2021. Unfortunately the policy document remains in draft form to date even as the taxation regime

spins into a chaotic mix of opinions and desires bereft of sound national policy direction

A review of the draft National Tax Policy published in the National Treasury website clearly shows the policy gaps and what the National Treasury is trying to cure in filling these policy gaps. The document is rich in content and provides all options for legal and regulatory framework that should guide tax policy decisions going forward.

Just as has been severally demanded by practitioners, the policy document’s introductory statement, enumerates the foundation upon which this policy is built. Primarily, the National Tax Policy aims at

providing an efficient and fair tax system that promotes equity and predictability in tax administration and offers a favorable tax environment for business operations. The policy if adopted is envisioned to set parameters, and offer guidelines and benchmarks on tax related issues. This policy provides a basis for tax legislation (which is sorely lacking at the moment), reviews and tax reforms while acting as a supporting cast in revenue mobilization and economic transformation.