By Dr. Jim McFie

You may know Professor Mike Chitavi. He has a Bachelor of Education degree from Kenyatta University (1991) and is a Certified Public Accountant of Kenya. He worked in the Nairobi office of KPMG for eight years, doing a stint in Johannesburg where he did a Higher Diploma in Computer Audit at the University of the Witwatersrand in 1997. In 1999 he went to do a Master of Business Administration degree at the Kellogg School of Management, Northwestern University, in Chicago. For a few years, he worked in business operations in the Financial, Auto and Healthcare industries. He held leadership positions of increasing responsibility at fortune 500 companies and traveled to over 33 countries. Between 2011 and 2016, he was the Chief Operating Officer of Linkage Capital Partners (a Hedge Fund with side-pockets of Private Equity) in Chicago. In 2015 he became an Adjunct Lecturer in Quantitative Business Applications at Chicago State University, a post he continues to hold to the present time. In 2016 he started lecturing finance at the University of Wisconsin, Whitewater, specializing in Capital Budgeting and simultaneously commenced his PhD in Finance. In 2018, having obtained his doctorate in finance, he became the Assistant Professor of Accountancy at Trinity Christian University, a liberal arts college in Palos Heights, Illinois, a southwestern suburb of Chicago. Mike’s research interest is in Asset Pricing. A statement of his on his web page acclaims: “Accounting is not just the language of business; it is also the lingua franca of money. Accounting therefore empowers business students to engage better in their future careers, irrespective of their roles later in life”.

That was a lengthy introduction for a single individual, but it gives an example of what has occurred to many young Kenyans who qualified at the time Mike did – they have succeeded spectacularly in whatever country they have chosen to move to abroad. I hope basic educational levels in Kenya continue to produce school leavers like Mike, something I find not to be the case – many Kenya Certificate of Secondary Education (KCSE) school leavers today lack the ability to think, to write and to speak coherently: this is a problem because an increasing number of young Kenyans will have to find employment abroad because Kenya’s economy is not expending fast enough to give them the opportunities to be employed at a level that will give them the professional satisfaction that a clever person is seeking.

I mention Mike because he was in Nairobi recently and he came to see me. I had just come out of a class and I mentioned that many of my students had copied something out of a textbook. I told the students that the book was wrong. Mike’s comment was immediate: “That is exactly what I too have to tell my students”. The purpose of this article is to correct some basic mistakes contained in many books on accounting.

One Wednesday evening when I was working as an audit senior in Ernst and Young (EY), I had just completed an audit and my next audit did not begin until the following Monday. I asked my audit manager whether he had a job that I could do on the Thursday and the Friday. It was the busy period and the writing up of the books of Updown Limited had not been done. Updown was a company that exported flowers to Europe and in which Charles Njonjo had a shareholding (if you look up the Kenya Gazette on-line you will find mention of Updown Limited).

My manager asked me if I would write up the books; I jumped at the opportunity to actually write up the books and produce the financial statements of a small company: I gladly accepted – and to this day, I am happy that I accepted. I was handed the manually written ledger and all the other documents in a brown cardboard box. I had to be begin by putting the various documents in order – something I actually love doing. I wrote up the cash book and the ledger and I remember exactly the physical location where I typed out the financial statements on the Sunday afternoon – on a typewriter – laptop computers were not yet in use. The ledger had been in use from the inception of the company: there were relatively few transactions over the year because large batches of flowers were sent off to Europe and so “sales” consisted of a limited number of numbers – quite different to a supermarket, for example. What I learnt is what I want to pass on to all accountants so that they avoid some basic mistakes. We will look at the ledger of a sole trader called Ali. He starts his business on 1st January 2018 by putting Kes 40 million into the business bank account.

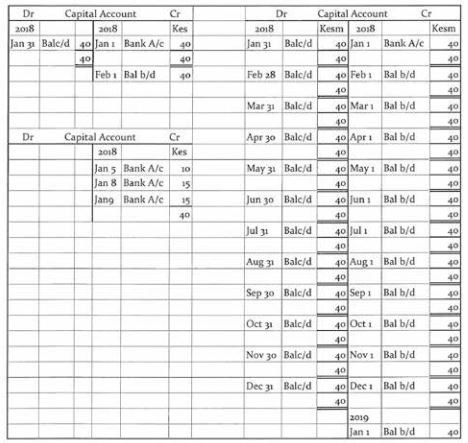

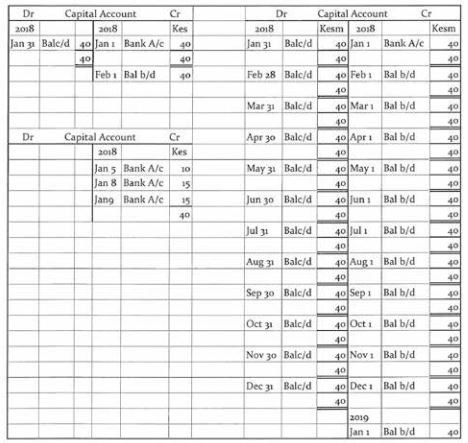

We will look at the ledger of a sole trader called Ali. He starts his business on 1st January 2018 by putting Kes 40 million into the business bank account.

Under Section 24(3) of the Kenya Income Tax Act, “the accounting period of a person carrying on any unincorporated Business shall be the period of twelve months ending on 31st December each year”. We will write up the ledger for the year to enable Ali to produce his statement of profit or loss for the year and the statement of financial position (the phrase Balance Sheet is still used almost exclusively in the United States and in the Kenya Companies Act 2015). Many books will show the capital account as it appears on the top left above: what is wrong with this account? The answer is that balancing off the accountant and carrying down the balance are two UNNECESSARY steps: they do NOT add any additional information. The FIRST single entry of Kes 40 million is SUFFICIENT: balancing off the account and bringing down the balance is a waste of time (and therefore of money). Let us take the ERROR on the top left above to its logical conclusion: the capital account on the right hand side above is how it would appear on that page of the ledger. In practice, balancing off and carrying down the balance on an account is necessary ONLY when there are debits and credits in the same month so that the balance on the account at the month-end is needed: if only debits appear in the account (as in purchases, returns inwards and expenses) or if only credits appear in the account (as in sales, returns outwards and income), it is sufficient to draw a line and insert the total, as in the second account above on the lower left.