CPA John Mucheru

At Bakertilly, we perform assurance and other engagements on hundreds of donor-funded projects across various jurisdictions in Africa. A rising trend is a presentation of project financial statements reflecting actual costs equal to an approved budget. This trend should be of interest to the donor community, external auditors, internal auditors, other compliance officers, finance managers and chief executives..

Ordinarily, the donor agrees to rules and regulations for projects implementation with an Implementing Partner in a form of Grant Agreement. The Implementing Partner is normally a Non-Governmental Organization or other Non-State Actors with capacity to execute the project. In addition to the guidelines of project implementation, a key component of this Grant Agreement is the approved project budget.

The budget constraints applicable for the project could include unit costs of items, nature of items, proportion of costs chargeable to the donor, co-financing requirements. The donor often requires the Implementing Partner to request approvals for expenditure exceeding budget above a specified threshold. In some instances, the donor prohibits excesses in budget categories such as personnel costs and administration costs.

Breach of budget constraints increases the risk of ineligible expenditure and as a result, such costs are refundable to the donor. Because of this, Implementing Partners develop ways of avoiding ineligible costs arising from excesses of expenditure above approved budget.

In our experience, project financial statements often reflect costs exactly equal to budget. This poses unique risks for the auditor and Implementing. Partners can misunderstand the Auditors’ concerns with such scenarios. Finance Managers often say, “We have not exceeded the budget!”.

What are the audit risks? Consider a project which entails distribution of household items to selected vulnerable members of the community. The project is implemented over a one-year period where beneficiaries can pick selected items from a vendor identified by the project implementation team. The vendor is a local retailer, and the project management has agreed a mechanism to account for the items picked including the records to be maintained.

The beneficiaries have a 1-year window to pick the entitled items and can pick them all at once or in piecemeal within the 1-year project implementation period. At the end of each month the vendor is required to compile records showing items collected and beneficiary details to facilitate payments. Once the project implementation team has verified those records, payments are made. At the end of the project period, the project implementation team prepares financial statements.

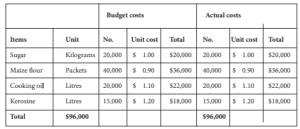

An extract of the financial statement is below:

Several questions should come to the Auditor’s mind. How is it possible for costs incurred to be exactly equal to budget? Are prices recorded accurate? Are the number of items reflected as purchased accurate? Is the total expenditure reflected accurate? These are audit risks to consider. Application of Analytical Procedures

The International Standards on Auditing (ISA) permits the use of Analytical Procedures as risk assessment procedures (ISA 315), in response to assessed risks (ISA 330) and further contribute to gathering of audit evidence (ISA 500). ISA 520 defines Analytical Procedures as “evaluation of financial information through analysis of plausible relationships among both financial and non-financial data.

Analytical procedures also encompass such investigation as is necessary of identified fluctuations or relationships that are inconsistent with other relevant information or that differ from expected values by a significant amount.” How accurate are the prices? The expectation is that prices of household consumable items would have fluctuated often within the 1-year period. How then can it be possible that the actual costs paid for the items remained constant over the 1-year period?

In addition, is there an impact on the purchase quantities recorded? Considering budget constraints and

given the expectation of fluctuation in prices over a prolonged period, a further expectation is that actual units paid for would fluctuate as well. If cumulatively, prices exceeded budget, expectation is that units purchased are lower than budget. Where prices are below budget over the period, it means units purchased might be higher than planned.

Therefore,for the Auditor,a presentation of costs incurred exactly equal to budget is an unlikely expectation The possibility of actual costs equals to budget For certain project costs such as salaries which are easily foreseeable with certainty,actual costs equal to budget is a possibility.However,it is least expected that actual costs are equal to budget for consumables, it can occur.

With a robust budget tracking system, a project can manage its costs so that budget limits are not exceeded. This calls for project finance managers to deploy tools enabling such detailed tracking. Pre-negotiated prices are another excellent means through which the project can increase its chances of

remaining within the budget. As part of the procurement process, the project managers can negotiate and agree fixed prices which conform with the approved budget.

The vendor must then also guarantee availability of items when needed. What this means for project managers is that extensive due diligence of the capacity of vendors is performed. In-order to ensure transparency in the procurement process and demonstrate budget control efforts made, any strategies deployed to manage costs should be documented and preserved as evidence of the processes followed to support the financial statements.

Several questions should come to the Auditor’s mind. How is it possible for costs incurred to be exactly equal to budget? Are prices recorded accurate? Are the number of items reflected as purchased accurate? Is the total expenditure reflected accurate? These are audit risks to consider.

Conclusion

When presented with project financial statements reflecting actual costs incurred equal to budget, External Auditors, Internal Auditors, and other Compliance Officers can use a variety of techniques to determine the accuracy of financial statements. It is the responsibility of Finance Managers to present documentation demonstrating the costs management techniques used and therefore support the accuracy of the financial statements. It is the responsibility of auditors and compliance officers to consider if the evidence provided supports the project financial statements.